“At Archipel, we aim to completely relieve the entrepreneur of his tax affairs, so that he can focus on doing what he does best – creating value for his business and society.”

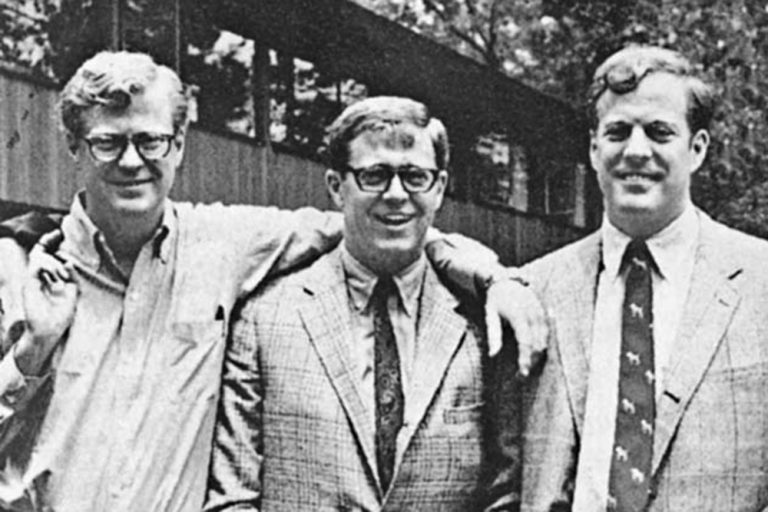

During my university studies I gained experience at Archipel Tax Advice as a Trainee Tax Advisor. After having obtained my master’s degree in Fiscal Economics I joined Archipel as a Tax Analyst, where I seek to combine my knowledge of tax law, accounting and economics in order to create value for our clients.

Being the co-owner of a startup, I have a special interest in the taxation of startups and scale-ups. I’ll gladly identify the opportunities and weaknesses of a business from a tax perspective. Supporting growth firms requires proficiency in fiscal benefits and encouraging measures, and an opportunity-based approach to taxes. Fortunately, the Dutch government supports such businesses through fiscal incentives. Let’s do business!