Deeptech companies are set to be the driving force behind global transitions. And for the avoidance of any doubt, I see Deeptech as innovations based on advanced scientific and engineering breakthroughs, that typically involve technologies like AI, quantum computing, or biotechnology.

With the Netherlands being a small country with a high-income economy, limited natural resources and little manufacturing, the Netherlands holds a heavy R&D focused business ecosystem. And since Deeptech companies are, by design, highly research driven, the Netherlands’ track record for innovative companies serves as a foundation for the increasing number of Deeptech companies that choose the Netherlands as their ‘place to build’.

This increasing presence of Deeptech companies in the Dutch tech ecosystem also leads to more VC investment, as is highlighted by Techleap’s State of Dutch Tech 2024 [to be found here https://techleap.nl/report/state-of-dutch-tech-report-2024/].

The influx of Deeptech companies in the Netherlands is clear, and they are here to stay. If you are a Founder of a Deeptech Company or otherwise involved in the scene, we can imagine that the tax side of things might be overwhelming. To help you navigate trough the Tax Law Maze, we identify 5 Tax Considerations for Dutch Deeptech companies and walk you through them.

Leverage Academic Developed IP with Business Driven Spin-Off Deal Terms.

Deeptech companies often revolve around intellectual property [IP] that has been developed at a University. Once the technology reaches a certain level of maturity, the researchers may spin it out into a Deeptech company. These companies then build their business around commercializing and further developing the IP. Such spin-off companies face a bit of a crossroads; since Dutch universities are publicly funded, the development of the IP was partially funded by taxpayers money. As a result, universities feel an obligation to recover those costs or even share in the potential success if the spin-off becomes highly profitable.

This often resulted in universities negotiating a deal with the startup-to-be about IP and equity that was fully in favor of these universities and often showed more similarities with VC-deal terms than what you would expect from a public institution.

To avoid the complications of deal-by-deal negotiations and overly aggressive deal terms, Dutch universities collaborated with entrepreneurs and investors on a Techleap-facilitated platform. Together, they developed a standardized set of deal terms designed to streamline the process, making it more efficient and predictable for all parties involved.

These Standard Spin-Off Deal Terms form the basis on which the developed IP will be transferred to the company. In exchange, the University will receive:

- A dilutive equity share;

- A License Agreement with Royalty Payment; or

- A combined Equity and Royalty deal.

We dive into these options in more detail in this article:

All these three Spin-Off options hold their own unique set of cap table legalities and tax consequences. We often help companies to structure a cap table that aligns with their [long term] business plans, and we would be happy to walk you through them!

Set Up a Corporate Structure that Protects IP.

Since the developed IP is crucial to your business, protecting the IP is just as crucial. When [let’s hope not!] the company will experience financial difficulties and go bankrupt, you run the risk of losing the IP. The receiver in bankruptcy can namely sell the IP in order to pay off any debts.

As legal entities are responsible for their own assets and liabilities, corporate law muscle memory dictates that setting up separate entities for different activities and different risks, ring-fences these risks. Dedicating a separate legal entity for the IP, means that the IP will be secured in the event of [a hopefully unlikely] bankruptcy. This also means that the chances of a successful Chapter 11increase. Investors favor such a corporate setup.

Our Blueprint of a Corporate Structure that Protects IP, therefore entails multiple legal entities and looks like this:

- The IP & Patent Co is the legal owner of the IP.

- The R&D Co is the entity that employs the R&D staff members. By separating the R&D staff members from the entity that holds the IP, any R&D-related staff risks are ring-fenced and do not affect the IP.

- The Sales Co is the entity that engages in external [sales] contracts and employes the other [non-R&D] staff members. This way, any operational risks are ring-fenced from the IP and R&D.

- The Top Holding creates a single investing entity for potential investors in all underlying entities, allowing them to participate at the same level as the Founders. The Top Holding also creates the possibility to form a Tax Group, which means that the separate entities are taxed as one single entity. This allows for an easier transfer of assets within the group.

Want to read more about our Blueprint for an IP Centered Corporate Structure? Read our earlier article:

Apply the WBSO Scheme [R&D Deduction] and the Innovation Box [CIT Break] to lower the Tax Burden.

Innovation is a key driver of the Dutch knowledge-based economy, where value is created through intellectual capital, rather than physical resources. To foster innovation and R&D activities, the Netherlands builds policy around the aim of being an innovative economy. And that policy encompasses specific measures to encourage R&D taking place within the Netherlands.

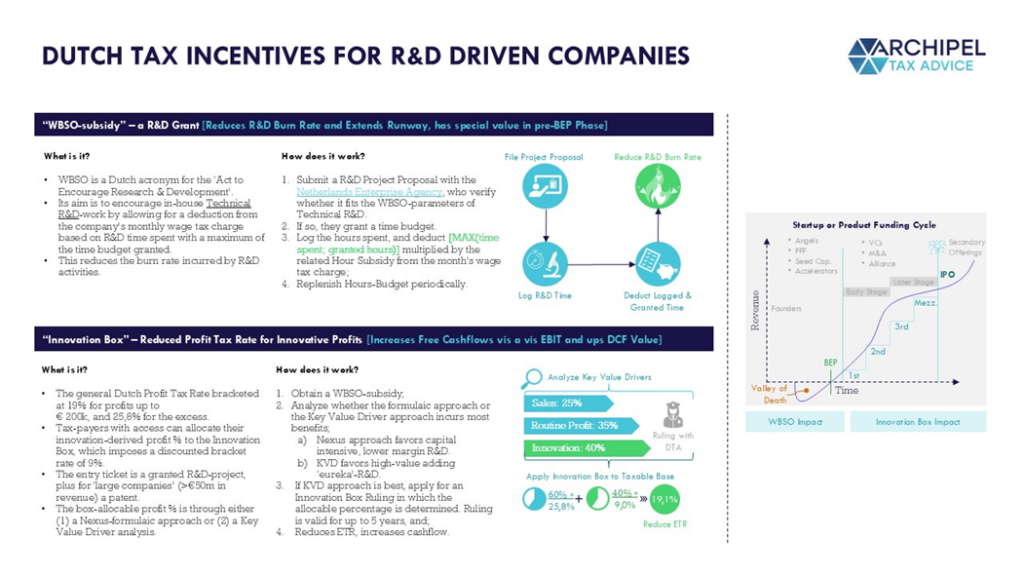

This is achieved by [1] the WBSO, which significantly lowers wage taxes for payrolled staff members conducting R&D activities in the Netherlands and [2] the Innovation Box, that offers a special corporate tax rate for profits generated from R&D. With Deeptech companies being heavily research driven, the WBSO and the Innovation Box can lower the Effective Tax Rate, and as such increase the company’s Free Cashflows. This leads to additional funds that can be reinvested into further R&D activities, fueling continuous innovation and business growth.

Check out our earlier article about the WBSO and the Innovation Box:

Incorporate an Employee Incentive Plan to Kickstart Further Business Growth.

The first Business Phase of a Deeptech company is typically characterized by a heavily developing and cash-burning character. Implementing an Employee Incentive Plan during this critical period can be highly beneficial for several reasons:

1. Talent Retention in a Competitive Market.

Deeptech companies often rely on specialized, highly skilled employees who are critical to their innovation and product development. Offering an Incentive Plan helps retain these valuable employees in a competitive market where talent is scarce and frequently poached by competitors or big [tech] companies.

2. Aligning Employee Interests with Long Term Business Goals.

In the early stages, Deeptech companies might not have immediate profitability but require employees to work towards long term innovation and success. Incentive Plans, especially equity based ones, align employees’ interests with the company’s long term business goals. Employees are motivated to contribute to the success of the company because their personal financial outcomes are directly tied to the company’s performance.

3. Compensating for Lower Salaries.

During the cash-burning phase, Deeptech companies often face financial constraints and may not be able to offer competitive salaries compared to more established competitors. Incentive Plans can compensate for this by offering non-cash benefits such as equity. This allows companies to attract and retain top talent while conserving cash for operational needs.

4. Encouraging Innovation and Ownership.

Deeptech companies rely heavily on continuous innovation to maintain a competitive edge. An incentive plan that rewards creative problem-solving and technological breakthroughs can encourage employees to think outside the box and invest in the company’s success as if it were their own. Employees feel a sense of ownership over the company’s future, driving greater commitment to the company’s long term vision.

5. Attracting Investors and Signaling Growth Potential.

Investors are more likely to support Deeptech companies that have strong incentive structures in place because they know that key employees have a stake in the company’s success. A well-designed Incentive Plan signals to investors that the company is focused on long term value creation, which can make it easier to secure additional funding during critical phases of development.

Now that we have identified why an Employee Incentive Plan can kickstart further business growth, you may wonder what options there are. The options are endless, because the various decision making points allow for a tailor made Incentive Plan. However, to streamline this decision making process, we like to discriminate between Salary Based plans and Equity Based plans, and then between 5 sub-types within these main categories. Each [sub]category comes with its unique pro’s and cons, and tax implications.

Read this Insight to learn more about the various Employee Incentive Plan options:

Design a Fitting Transfer Pricing Policy when Expanding Abroad.

There might come a time when foreign businesses opportunities become enticing. Given the mentioned corporate law principles, newly formed entities will constitute the foreign business presence. As any after tax profits should, in a well designed structure, be distributed tax-free as dividend under the Dutch Participation Exemption to the Dutch shareholder, the question would be what profits should be allocated to the foreign branch. This is a matter of Transfer Pricing.

When related entities engage in transactions, shareholder incentives can influence the pricing arrangements. For Deeptech companies, these intercompany transactions often involve IP licenses, R&D services, and cross-border sales of innovative products. There may then be a temptation to have a company in a low-tax jurisdiction charge an inflated service fee to a company in a high-tax jurisdiction, effectively shifting profits to the low-tax country and consolidating them under a centralized holding entity. However, the Arm’s Length principle requires that the pricing between related parties, for tax purposes, must be determined as if they were separate and independent entities. The appropriate pricing is established by evaluating the functions performed and risks assumed by each party.

By [1] creating a fitting corporate structure considering these functions and risks, and subsequently [2] designing a fitting transfer pricing policy that allocates profits to the Netherlands, the Dutch Innovation Box can be fully leveraged.

Other aspects to keep in mind.

IP Valuation

The core of a Deeptech company’s value lies in its IP. Properly valuing this IP and setting appropriate pricing for licensing it to foreign subsidiaries, stresses compliancy and maximizes the different tax regimes. This valuation should be supported by a robust analysis, taking into account the IP’s unique attributes and market potential.

Advance Pricing Agreements [APAs)

In some cases, obtaining an APA with the Tax Authorities can provide certainty and reduce the risk of potential disputes. This is particularly valuable for Deeptech companies with significant IP and R&D-driven profit streams, as it allows them to secure approval on their transfer pricing policies in advance.

Want to learn more about Transfer Pricing? Read our Transfer Pricing 101 here:

For a more in-depth explanation of the different Transfer Pricing methods, we refer to this insight:

Want to discuss your Deeptech Business and tax? Book a slot, it’s on the house!

Looking forward to learning about your business, and sharing some thoughts!