Global businesses with activities in the Netherlands – please be advised about the new Dutch ‘Entity Tax Classification’ [or ‘Classification’] rules as of 2025. These new rules change the way we determine the tax classification of legal entities: Transparent or Non-Transparent for tax purposes. In this contribution, we’ll walk you through the new Dutch Tax Classification framework and the new Draft Decree. Our Max Regtuit and Sietse Roosdorp dive in.

Quick primer: the Tax Classification of entities and legal forms pertains to identifying them as ‘Transparent’ [not individually liable to tax with the income attributable directly to their owners/participants/shareholders] or ‘Non-Transparent’ [individually liable to tax].

For entities incorporated according to Dutch law, the framework is clear and written-up per type. However, as one can also do business in the Netherlands through legal forms not incorporated as per Dutch law [for instance, an English LP or a German GmbH & Co KG], a certain working framework must be in place to ensure [1] classification at all, and [2] a classification that avoids Double Taxation or Double Non-Taxation due to classification mismatches with other states.

So: in this article, ‘Entity Classification’ [in Dutch more literally but in our eyes less suitably: Entity Qualification] means its classification as [a] Transparent & not-liable to tax, or [b] Non-Transparent [‘Opaque’] and liable to tax.

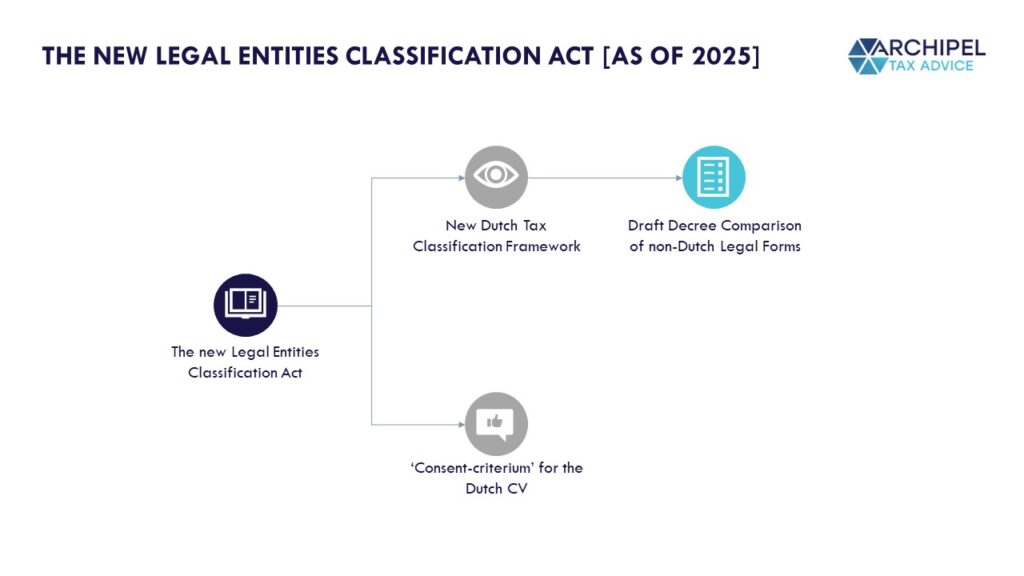

An important background is that the Dutch tax classification rules of the Dutch Commanditaire Vennootschap (‘CV’, an LP-ish form) and other non-Dutch legal forms will change as per January 1, 2025. Notably, Dutch CVs are no longer classified depending on whether its members [Partners] can freely leave the Partnership [Transparent] of not [Non-Transparent], but will become Tax Transparent regardless. As a result, the existing framework to determine non-Dutch legal forms’ classification through a comparability analysis based mainly on the classification framework for domestic CVs no longer works. The introduction of the Legal Entities Classification Act (‘the Act’) should therefore bring the Dutch tax classification rules in line with domestic rules and international standards [the first having already been adjusted to reflext the latter].

The ‘Act’ will not be a singular ‘law’ but contains a series of changes that will be made to the different Laws / Acts that currently impact or are impacted by Entity Classifications and includes the implementation into law of novel ‘legal form comparison methods’. Recently, a public consultation was published regarding the introduction of the Decree comparison of non-Dutch legal forms (‘the Draft Decree’). The Draft Decree elaborates on the legal form comparison method and includes a list of the comparability of a limited amount of non-Dutch legal forms (‘the List’).

About the New Dutch ‘Tax Classification’ Framework and its Goals

The new Act will take effect as per 2025 and its goal is to avoid ‘hybrid mismatches’ resulting from classification discrepancies between the Netherlands and other involved jurisdictions [please see an example of a hybrid mismatch and its possible consequences explained below]. This should be accomplished through the introduction of:

- The new Dutch tax classification framework (‘the new Framework’) provides instructions on how to ‘classify’ comparable but non-Dutch legal forms for Dutch tax purposes. and includes additional methods for situations in which a non-Dutch legal form is *not* comparable to the entity types known under Dutch laws, and;

- In extension, new rules for the classification of domestic legal forms, mainly pertaining to the abolishment of the ‘consent-criterium’ for Dutch “CVs'” [LP-type form]. In this contribution, we will focus only on the new Framework, being first part of the new Act.

The new Framework will be implemented through changes made to certain parts of the following Dutch tax Laws/Acts:

- the Corporate Income Tax Act (‘CIT’);

- the Dividend Withholding Tax Act (‘DWHT’);

- the Conditional Withholding Tax Act (‘CWHT’); and

- the Personal Income Tax Act (‘PIT’).

Why is the avoidance of Hybrid Mismatches a priority?

Tax Transparent entities are not individually taxable. This can be a logical consequence to the way certain legal forms are seen in jurisdictions. For instance: a ‘Fund’ is often just a contract agreement that stipulates how investor’s money is pooled and invested on their behalf, and how the proceeds are shared between the investors and the investment manager. The proceeds are often directly attributed to the underlying investors as the ‘Fund’ is not considered to be a separate body, but rather an investment agreement between the investment manager and the investors.

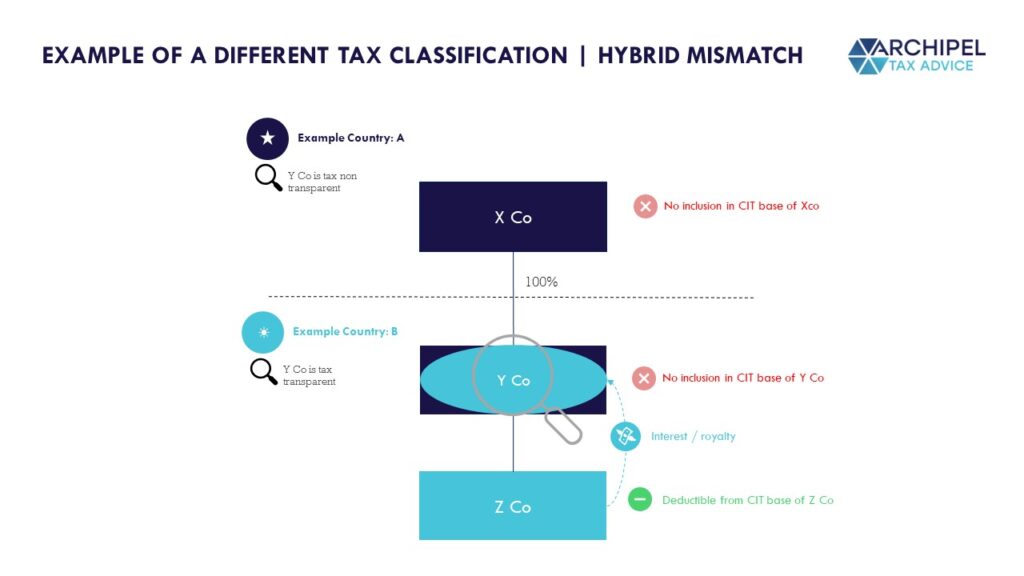

But: not every jurisdiction may have the same views on whether and under which conditions Fund-setups [for instance] are and aren’t separately liable to tax. That can give rise to Double Taxation or Double Non-Taxation on income. For example:

Y Co is a so-called hybrid entity: it is considered tax transparent by fictive country B and tax non transparent in fictive country A. In this example, Z Co pays an interest or royalty. At the Z Co level, the interest or royalty expense is deductible. For Y Co, the received interest or royalty payment has no pickup and is therefore not included in Y Co’s tax base. At X Co level, there is also no pickup due to the different tax classification of Y Co in country A. We note that the introduction of the new rules in the EU Anti-Tax Avoidance Directive (‘ATAD’) 2[1] already limits the non-deductibility in combination with the non-inclusion in this example.[2] However, the current Dutch tax classification rules are currently not aligned with international standards and therefore may still result in hybrid mismatches.

[1] Please see the articles implemented in the Dutch CIT Act, such as article. 12aa – article 12ag CIT Act.

[2] If the Netherlands were Country B, the consequences of this hybrid mismatch are ‘fixed’ by article 12aa (1) (e) CIT Act: the payment is not deductible if the payment is not included in the tax base of Y Co.

What is the Background to the new Dutch Entity Classification Act?

Under the current legal form comparison method, non-Dutch legal forms are classified through ‘assimilation’: they are compared to known Dutch legal forms (such as: Besloten Vennootschap (‘BV’ similar to LLC), naamloze vennootschap (‘NV’ or Inc), associations (in Dutch: ‘vereniging’), foundations (in Dutch: ‘stichting’), or Commanditaire Vennootschappen (‘CVs’ similar to LPs).[3]

The Dutch Ministry of Finance analysed the current Dutch tax classification rules and regards the legal form comparison method as still effective, partly due to the fact that it aligns with (EU) case law.[4] Despite the effectiveness, for some businesses the classification policy does not give certainty on its Dutch tax classification in case the non-Dutch legal form is not comparable with a Dutch legal form. In that case, for example, it is not certain whether a non-Dutch legal form would be considered liable to Dutch CIT. The new rules should give businesses more certainty about the tax classification of non-Dutch legal forms.

[3] The State Secretary sets outs its view on the Dutch tax classification rules in the Classification Policy Decree (in Dutch: ‘Kwalificatiebesluit’) based on Dutch case law.

[4] Kamerstukken II 2023/24, 36425, nr. 3, p. 4.

Three Methods to Determine the Dutch Tax Classification of non-Dutch Legal Forms:

To give more certainty on the Dutch tax classification of non-Dutch legal forms, the new Framework introduces a different approach for non-Dutch legal forms that are considered incomparable to any known Dutch legal form. This approach consist of the so-called ‘Fixed Method’ and the ‘Symmetrical Method’:

- In case the non-Dutch legal form is located in the Netherlands: the Fixed Method applies, and dictates that the non-Dutch legal form is tax non-transparent.

- In case a non-Dutch legal form is not located in the Netherlands: the Symmetrical Method applies and dictates that the Dutch tax classification follows the tax classification of the jurisdiction where the non-Dutch legal form is located.

Example of the Fixed Method

In this example, a Dutch BV entity holds a 5% substantial interest in a Netherlands-based Limited Liability Partnership (‘LLP’) incorporated under the laws of the UK. We identify the following steps:

- Based on the List included in the Draft Decree, an LLP incorporated under the laws of the UK does not have a Dutch comparable legal form.[5]

- Because the LLP is located in the Netherlands, the fixed method should be applied. As a result, the LLP is regarded as domestically liable to Dutch CIT.

- Due to the fact that this LLP is non-transparent, the parent-BV would, for example, have access to the Dutch participation exemption in the CIT for dividends and/or capital gains on shares derived from this LLP – assuming that the other requirements of the participation exemption are met.[6]

[5] Draft Decree, p. 9.

Example of the Symmetrical Method

In the next example, a Dutch BV holds a 5% shareholding in an LLP, this time located in the UK. In this case we identify the following steps:

- The LLP, incorporated under the laws of the UK, is not included on the list in the Draft Decree, the symmetrical method applies as the LLP is not located in the Netherlands.

- In this example, we presume that this LLP is non-transparent from a UK tax perspective – and please always check this with a UK tax advisor.

- Based on the symmetrical method, the Dutch tax classification follows the tax classification of the UK. This would mean that the Netherlands will classify the LLP as non-transparent for tax purposes.

- Also in this case, the Dutch parent-BV would have access to the Dutch participation exemption in the CIT for capital gains and/or dividends received from the UK LLP – again assuming the other requirements of the participation exemption apply.[7]

The Newly Published Draft Decree

The Draft Decree explains how the legal form comparison method should be applied. Based on the Draft Decree, a non-Dutch legal form would be regarded as ‘comparable’ if the non-Dutch legal form is ‘sufficiently comparable’ with a Dutch legal form based on the nature and the design of the non-Dutch legal form. The nature of the non-Dutch legal form consist of an analysis of the position of the non-Dutch legal form in the legal form framework in that jurisdiction. Also, the intention of the introduction of the legal form by the local legislator should be analysed.

The analysis should be based on parliamentary sessions, explanatory memorandums, or other relevant legal implementation documents in a foreign jurisdiction. The position and the intention could for example answer the question whether the legislator chose to classify the legal form as a partnership or a limited liability type of company. The design of the non-Dutch legal form takes into consideration the relevant features of the non-Dutch legal form, such as the role between the legal form and its participants, the liability of participants, and whether the legal from has legal personality.

Which International legal forms are Sufficiently Comparable to existing Dutch legal forms?

The Draft Decree includes a List with the comparability of a limited amount of non-Dutch legal forms. In principle, this List is decisive to determine the comparability with Dutch legal forms. The List is not decisive in the situation that the law of a foreign state is (recently) modified in relation to the non-Dutch legal form. In addition, the classifications that follow from the List are irrelevant in the situation that the non-Dutch legal form classifies as a mutual fund or transparent fund under the Dutch CIT and/or PIT. It is expected that the List will be updated with more non-Dutch legal forms during 2024.

In case a non-Dutch legal form is not included on the List, the non-Dutch legal form should be ‘sufficiently comparable’ with a Dutch legal form to be considered a comparable Dutch legal form. The phrase ‘sufficiently comparable’ is regarded in literature as a vague and open standard.[8]

[8] G.K. Fibbe & A.J.A. Stevens, ‘Het (consultatie-)besluit vergelijking buitenlandse rechtsvormen’, WFR 2024/69, afl. 7517, p. 14 – 21; W.R. Kooiman, C.J. van Hoek & F.A. Spiekerman, ‘Naar een nieuw kwalificatiekader buitenlandse rechtsvormen’, WFR 2024/68, afl. 7517, p. 6 – 13.

How to compare?

To compare the design of the non-Dutch legal form, the Draft Decree includes per Dutch legal form the relevant characteristics. It is stated that that the characteristics of the Dutch legal forms included in the Draft Decree are given equal weight.[9] Therefore, it is unclear which characteristics would be decisive to arrive at a proper comparison of the design of the non-Dutch legal form. It is also unclear how the nature of the non-Dutch legal form should be analysed and what weight should be given to that in the comparability analysis. Noteworthy is that the Draft Decree does not include any explanation relating to the nature of Dutch legal forms. So, no parliamentary explanatory memorandums or other relevant historical documents are given to determine the historical nature of the Dutch legal forms.

In case the characteristics of a non-Dutch legal form would be considered sufficiently comparable to those of the characteristics of one of the Dutch legal forms, the non-Dutch legal form would be comparable to that Dutch legal form. In that case, the Dutch tax classification of the non-Dutch legal form would follow the tax classification of the comparable Dutch legal form. So, if the non-Dutch legal form is considered sufficiently comparable with a Dutch BV, the non-Dutch legal form would classify as a non-transparent entity as the BV is non-transparent for Dutch tax purposes.

[9] Draft Explanatory Note Decree on comparison of foreign legal forms, p. 10.

What if the non-Dutch legal form is not comparable?

In case the non-Dutch legal form is comparable to none, two, or more Dutch legal forms, the non-Dutch legal from would be considered a non-comparable type of non-Dutch legal form.[10] For these type of legal forms, the fixed and symmetrical method would determine their Dutch tax classification [please see the examples of both methods above]. Note that non-Dutch legal forms that are comparable with -for example- two Dutch legal forms that are non-transparent for Dutch tax reasons [such as the Dutch BV and NV], the non-Dutch legal form is still considered to be non-comparable.

[10] Art. 2 (3) (a) Draft Decree. Also see: Concept Nota Draft Decree, p. 7.

What impact does the Draft Decree have?

Businesses that have a non-Dutch legal form in their international corporate structure, should take note of the possible consequences of the new Dutch tax classification rules as of 2025. The new classification rules impact both non-Dutch legal forms that hold other (foreign) entities, or that are held by a Dutch BV or NV. We note that the consultation of the Draft Decree ended March 18, 2024. It is expected that the final version of the Draft Decree will be adopted during 2024 – at least before the new classification rules take effect. Although the final version of the Draft Decree is not yet adopted, the Draft Decree already indicates which non-Dutch legal forms would not be comparable with Dutch legal forms. For these legal forms, the fixed and symmetrical method will determine their Dutch tax classification. Below we listed all the non-Dutch legal forms that are currently included on the List of the Draft Decree and that are considered not comparable with a Dutch legal form based on the Draft Decree. Please see some of the foreign legal forms that are classified and included on the List in below picture. Note that US legal forms are not yet included on the List.

Want to discuss? Book a slot – it’s on the house!

If you have questions about the framework, or about how a potential ‘classification switch’ in your structure may impact you, please feel free to send them over and book a chat. I am happy to explore, and see if we can provide clarity!