In this post, we discuss how Dutch Tax Law determines whether an a Non-Dutch business structure is Tax Transparent or Taxable.

Structures with a tax transparent status are not subject to corporate income tax themselves; instead, their income and gains are directly attributed to their owners or participants, who are taxed individually based on their share of the income. Conversely, structures with a taxable status are considered separate taxpayers and are subject to corporate income tax on their profits. The ‘tax classification’ and treaty treatment of such income can be different and understanding these classifications is essential for effective tax planning, compliance with Dutch regulations, and managing cross-border tax obligations.

Generally speaking, the Netherlands would consider Partnership or Fund-like structures transparent, and Entity-like structures taxable. When foreign business structures are involved, however, determining what these strucures are most akin to can be a lot more squishy, and so a new framework was recently implemented, with additional guidance recently being published. In short:

- The final Decree connected to the new ‘Dutch Entity classification’ rules of non-Dutch legal forms has been published [Link].

- As of 1st of January 2025, the Decree gives guidance to the new rules to determine the Dutch tax classification of non-Dutch legal forms: Transparent or Non-Transparent [Taxable] for tax purposes.

- In this contribution, we’ll explain the changes to the new Decree in comparison with the Draft version and background information about the Dutch Tax Classification Framework.

New Entity Classification Rules

Under the ‘old regime’, a pivotal comparative role was played by the Dutch ‘CV’ [Commanditaire Vennootschap, comparable to a Limited Partnership]. Such a CV would be considered tax transparent [and more Partnership-like] if the involved partners would need to give prior consent for any of the partners to leave the partnership or for any partners to be added or replaced. Such type of a CV is known as a “Closed CV.” Conversely, an “Open CV,” a CV the framework of which does allow such changes to the member without prior unanimous consent, is more Entity-like and therefore taxable. The tax status of Non-Dutch entities was determined based on a decision tree built on this principle.

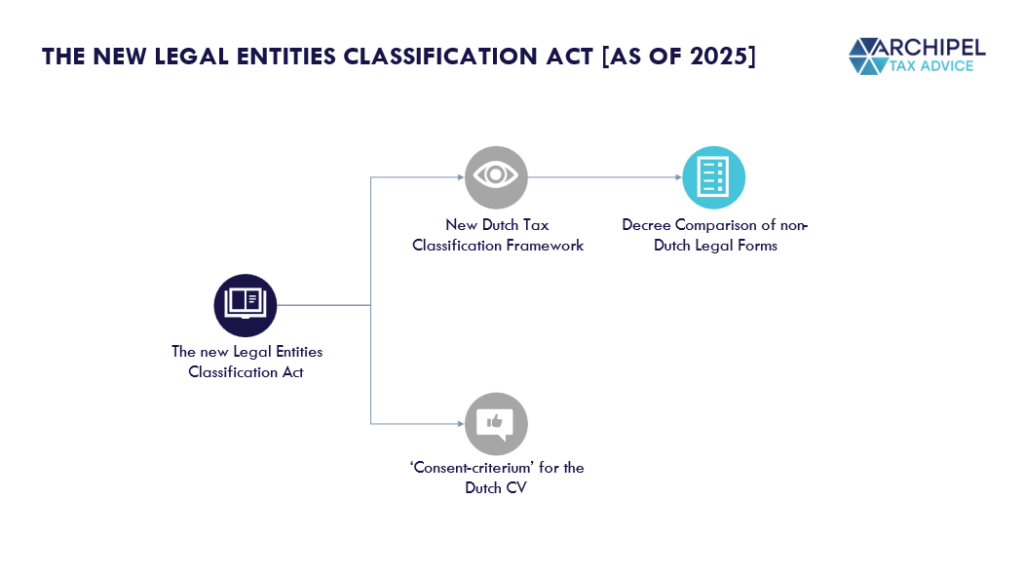

but: these classification rules for CVs and other non-Dutch legal forms changed as per January 1, 2025. Notably, Dutch CVs are no longer classified depending on their frameworks but will be Tax Transparent regardless. As a result, the existing framework to determine non-Dutch legal forms’ classification through a comparability analysis based mainly on the classification framework for domestic CVs no longer works. The introduction of the Legal Entities Classification Act (‘the Act’) should therefore bring the Dutch tax classification rules in line with domestic rules and international standards [the first having already been adjusted to reflect the latter].

Guidance in the Decree

The ‘Act’ will not be a singular ‘law’ but contains a series of changes that will be made to the different Laws / Acts that currently impact or are impacted by Entity Classifications and includes the implementation into law of novel ‘legal form comparison methods’. Beginning of 2024, a public consultation was published regarding the introduction of the Decree comparison of non-Dutch legal forms (‘the Decree’). In November 2024, the final version of the Decree was published. The Decree elaborates on the legal form comparison method and includes a list of the comparability of a limited amount of non-Dutch legal forms (‘the List’). The final version of the Decree includes some changes in comparison to the Draft version of the Decree, such as the addition of other non-Dutch legal forms to the List.

Relevant Changes to the Decree [in comparison with the draft version]

The tax classification of non-Dutch legal forms on the List only gives a presumption of the comparability with a Dutch legal form. Different from the draft version, the List is not decisive to determine the comparability of a non-Dutch legal form with a Dutch legal form.

The Dutch naamloze vennootschap (‘NV’)en besloten vennootschap (‘BV’) both fall into the same ‘bucket’ when making a comparison with a non-Dutch legal form. In the Draft Decree, a non-Dutch legal form was regarded as ‘non-comparable’ if the non-Dutch legal form was comparable to both a NV and BV. Because the NV and BV are similar, the ‘non-comparability’ was undesired and amended.

The comparability framework and the characteristics of the non-Dutch legal forms are explained more thoroughly in the explainer of the Decree to give more guidance when making a comparison between a non-Dutch legal form and a Dutch legal form.

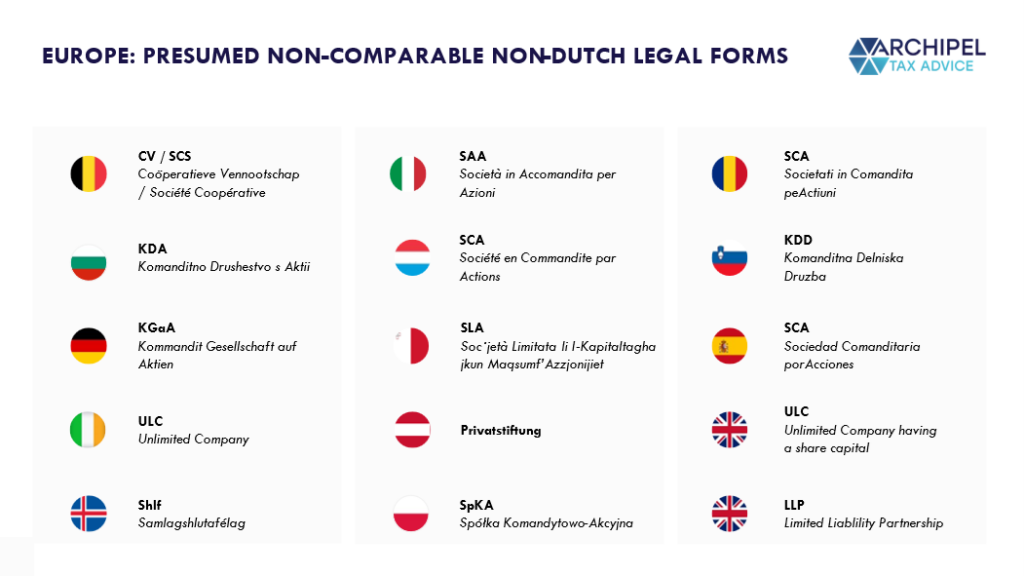

The presumptive comparability of more non-Dutch legal forms were added to the List. Whereas the draft version of the List included 8 non-Dutch legal forms that were ‘non-comparable’, the final version of the List includes 23 non-Dutch legal forms including also non-Dutch legal forms outside Europe.

Background: About the New Dutch ‘Tax Classification’ Framework and its Goals

The new Act will take effect as per 2025 and its goal is to avoid ‘hybrid mismatches’ resulting from classification discrepancies between the Netherlands and other involved jurisdictions [please see an example of a hybrid mismatch and its possible consequences explained below]. This should be accomplished through the introduction of:

- The new Dutch tax classification framework (‘the new Framework’) provides instructions on how to ‘classify’ comparable but non-Dutch legal forms for Dutch tax purposes. and includes additional methods for situations in which a non-Dutch legal form is *not* comparable to the entity types known under Dutch laws, and;

- In extension, new rules for the classification of domestic legal forms, mainly pertaining to the abolishment of the ‘consent-criterium’ for Dutch “CVs’” [LP-type form]. In this contribution, we will focus only on the new Framework, being first part of the new Act.

The new Framework will be implemented through changes made to certain parts of the following Dutch tax Laws/Acts:

- the Corporate Income Tax Act (‘CIT’);

- the Dividend Withholding Tax Act (‘DWHT’);

- the Conditional Withholding Tax Act (‘CWHT’); and

- the Personal Income Tax Act (‘PIT’).

Why is the avoidance of Hybrid Mismatches a priority?

Tax Transparent entities are not individually taxable. This can be a logical consequence to the way certain legal forms are seen in jurisdictions. For instance: a ‘Fund’ is often just a contract agreement that stipulates how investor’s money is pooled and invested on their behalf, and how the proceeds are shared between the investors and the investment manager. The proceeds are often directly attributed to the underlying investors as the ‘Fund’ is not considered to be a separate body, but rather an investment agreement between the investment manager and the investors.

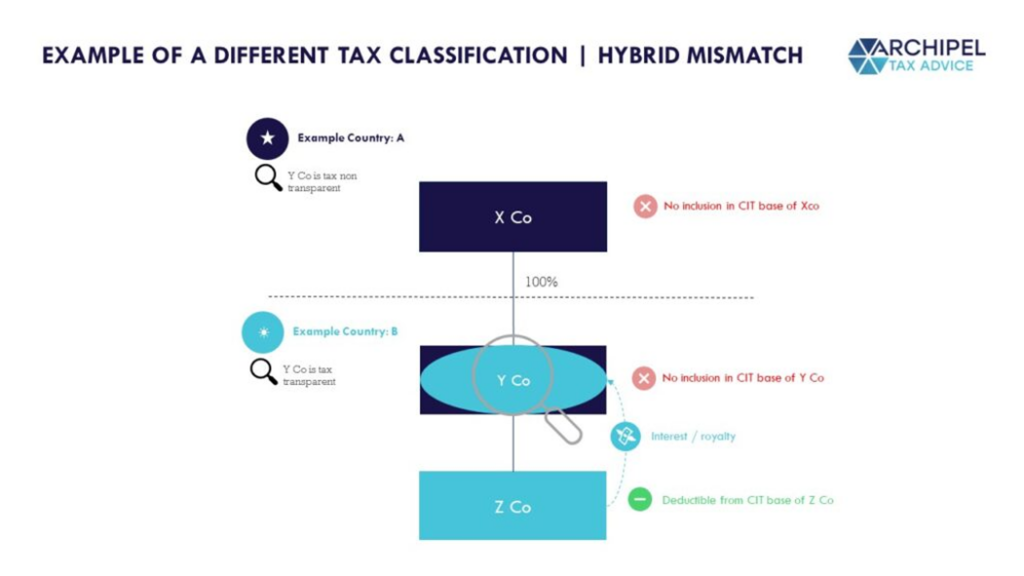

But: not every jurisdiction may have the same views on whether and under which conditions Fund-setups [for instance] are and aren’t separately liable to tax. That can give rise to Double Taxation or Double Non-Taxation on income. For example:

Y Co is a so-called hybrid entity: it is considered tax transparent by fictive country B and tax non transparent in fictive country A. In this example, Z Co pays an interest or royalty. At the Z Co level, the interest or royalty expense is deductible. For Y Co, the received interest or royalty payment has no pickup and is therefore not included in Y Co’s tax base. At X Co level, there is also no pickup due to the different tax classification of Y Co in country A. We note that the introduction of the new rules in the EU Anti-Tax Avoidance Directive (‘ATAD’) 2 already limits the non-deductibility in combination with the non-inclusion in this example. However, the current Dutch tax classification rules are currently not aligned with international standards and therefore may still result in hybrid mismatches.

The new Dutch Entity Classification Act

Under the current legal form comparison method, non-Dutch legal forms are classified through ‘assimilation’: they are compared to known Dutch legal forms (such as: Besloten Vennootschap (‘BV’ similar to LLC), naamloze vennootschap (‘NV’ or Inc), associations (in Dutch: ‘vereniging’), foundations (in Dutch: ‘stichting’), or Commanditaire Vennootschappen (‘CVs’ similar to LPs).

The Dutch Ministry of Finance analysed the current Dutch tax classification rules and regards the legal form comparison method as still effective, partly due to the fact that it aligns with (EU) case law.[4] Despite the effectiveness, for some businesses the classification policy does not give certainty on its Dutch tax classification in case the non-Dutch legal form is not comparable with a Dutch legal form. In that case, for example, it is not certain whether a non-Dutch legal form would be considered liable to Dutch CIT. The new rules should give businesses more certainty about the tax classification of non-Dutch legal forms.

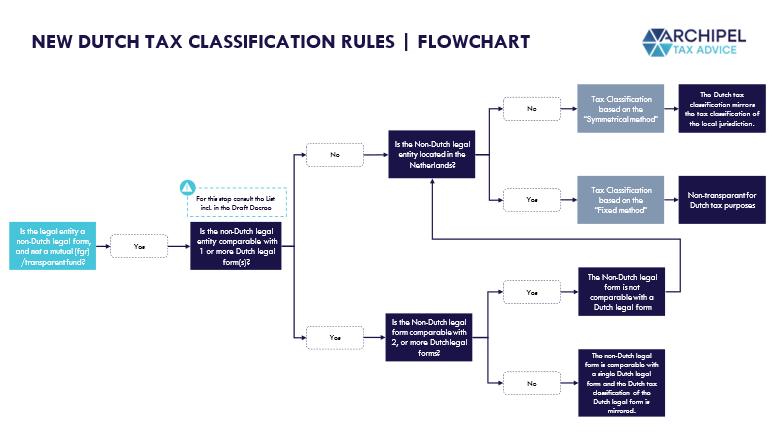

Three Methods to Determine the Dutch Tax Classification of non-Dutch Legal Forms:

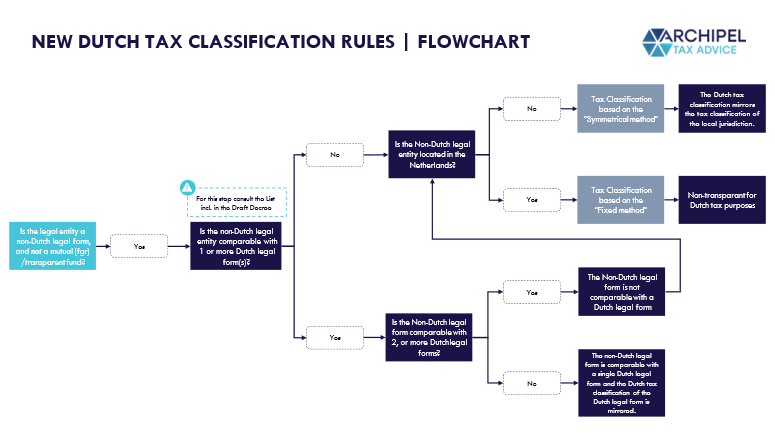

To give more certainty on the Dutch tax classification of non-Dutch legal forms, the new Framework introduces a different approach for non-Dutch legal forms that are considered incomparable to any known Dutch legal form. This approach consist of the so-called ‘Fixed Method’ and the ‘Symmetrical Method’:

- In case the non-Dutch legal form is located in the Netherlands: the Fixed Method applies, and dictates that the non-Dutch legal form is tax non-transparent.

- In case a non-Dutch legal form is not located in the Netherlands: the Symmetrical Method applies and dictates that the Dutch tax classification follows the tax classification of the jurisdiction where the non-Dutch legal form is located.

Example of the Fixed Method:

In this example, a Dutch BV entity holds a 5% substantial interest in a Netherlands-based Limited Liability Partnership (‘LLP’) incorporated under the laws of the UK. We identify the following steps:

- Based on the List included in the Decree, an LLP incorporated under the laws of the UK does not have a Dutch comparable legal form.

- Because the LLP is located in the Netherlands, the fixed method should be applied. As a result, the LLP is regarded as domestically liable to Dutch CIT.

- Due to the fact that this LLP is non-transparent, the parent-BV would, for example, have access to the Dutch participation exemption in the CIT for dividends and/or capital gains on shares derived from this LLP – assuming that the other requirements of the participation exemption are met.

Example of the Symmetrical Method:

In the next example, a Dutch BV holds a 5% shareholding in an LLP, this time located in the UK. In this case we identify the following steps:

- The LLP, incorporated under the laws of the UK, is not included on the list in the Decree, the symmetrical method applies as the LLP is not located in the Netherlands.

- In this example, we presume that this LLP is non-transparent from a UK tax perspective – and please always check this with a UK tax advisor.

- Based on the symmetrical method, the Dutch tax classification follows the tax classification of the UK. This would mean that the Netherlands will classify the LLP as non-transparent for tax purposes.

- Also in this case, the Dutch parent-BV would have access to the Dutch participation exemption in the CIT for capital gains and/or dividends received from the UK LLP – again assuming the other requirements of the participation exemption apply.

The Newly Published Decree

The Decree explains how the legal form comparison method should be applied. Based on the Decree, a non-Dutch legal form would be regarded as ‘comparable’ if the non-Dutch legal form is ‘comparable’ with a Dutch legal form based on the nature and the design of the non-Dutch legal form. The nature of the non-Dutch legal form consist of an analysis of the position of the non-Dutch legal form in the legal form framework in that jurisdiction. Also, the intention of the introduction of the legal form by the local legislator should be analyzed.

The analysis should be based on parliamentary sessions, explanatory memorandums, or other relevant legal implementation documents in a foreign jurisdiction. The position and the intention could for example answer the question whether the legislator chose to classify the legal form as a partnership or a limited liability type of company. The design of the non-Dutch legal form takes into consideration the relevant features of the non-Dutch legal form, such as the role between the legal form and its participants, the liability of participants, and whether the legal from has legal personality.

Which international legal forms are Comparable to existing Dutch legal forms?

The Decree includes a List with the comparability of a limited amount of non-Dutch legal forms. The List gives a presumptive judgement about the comparability of a non-Dutch legal form with a Dutch legal form. Note that in the situation that the law of a foreign state is (recently) modified in relation to the non-Dutch legal form the List cannot be used. In addition, the classifications that follow from the List are irrelevant in the situation that the non-Dutch legal form classifies as a mutual fund or transparent fund under the Dutch CIT and/or PIT.

How to compare?

To compare the design of the non-Dutch legal form, the Decree includes per Dutch legal form the relevant characteristics. It is stated that that the characteristics of the Dutch legal forms included in the Decree are given equal weight. Therefore, it is unclear which characteristics would be decisive to arrive at a proper comparison of the design of the non-Dutch legal form. It is also unclear how the nature of the non-Dutch legal form should be analyzed and what weight should be given to that in the comparability analysis. Noteworthy is that the Decree does not include any explanation relating to the nature of Dutch legal forms. So, no parliamentary explanatory memorandums or other relevant historical documents are given to determine the historical nature of the Dutch legal forms.

In case the characteristics of a non-Dutch legal form would be considered comparable to those of the characteristics of one of the Dutch legal forms, the non-Dutch legal form would be comparable to that Dutch legal form. In that case, the Dutch tax classification of the non-Dutch legal form would follow the tax classification of the comparable Dutch legal form. So, if the non-Dutch legal form is considered comparable with a Dutch BV, the non-Dutch legal form would classify as a non-transparent entity as the BV is non-transparent for Dutch tax purposes.

What if the non-Dutch legal form is not comparable?

In case the non-Dutch legal form is comparable to none, two, or more Dutch legal forms, the non-Dutch legal from would be considered a non-comparable type of non-Dutch legal form. For these type of legal forms, the fixed and symmetrical method would determine their Dutch tax classification [please see the examples of both methods above]. Note that non-Dutch legal forms that are comparable with -for example- two Dutch legal forms that are non-transparent for Dutch tax reasons [excluding the Dutch BV & NV and maatschap & VOF ], the non-Dutch legal form is still considered to be non-comparable.

What impact does the Decree have?

Businesses that have a non-Dutch legal form in their international corporate structure, should take note of the possible consequences of the new Dutch tax classification rules as of 2025. The new classification rules impact both non-Dutch legal forms that hold other (foreign) entities, or that are held by a Dutch BV or NV.

The Decree indicates which non-Dutch legal forms would not be comparable with Dutch legal forms. For these legal forms, the fixed and symmetrical method will determine their Dutch tax classification. Above, we listed all the non-Dutch legal forms that are currently included on the List of the Decree and that are considered not comparable with a Dutch legal form based on the Decree.

This framework impact any Business Structurings that include transparent structurings, most often seen in Fund and other Investments setups.

Want to Discuss? Book a slot to talk – it’s on us!

Feel free – I’m eager to dive in!