Startups and scaleups are increasingly being lauded for their essential role in innovation and the job market. That makes young businesses with ambitions to grow their solution-based calling into a commercial force not only exciting, but downright crucial for advancement.

And that is why the Dutch government designs to support such businesses. Through taxes, amongst others actually. So even though an old saying goes that whomever tries to grow their business finds the tax authorities on their way, that confluence is increasingly sprinkled with good news and support.

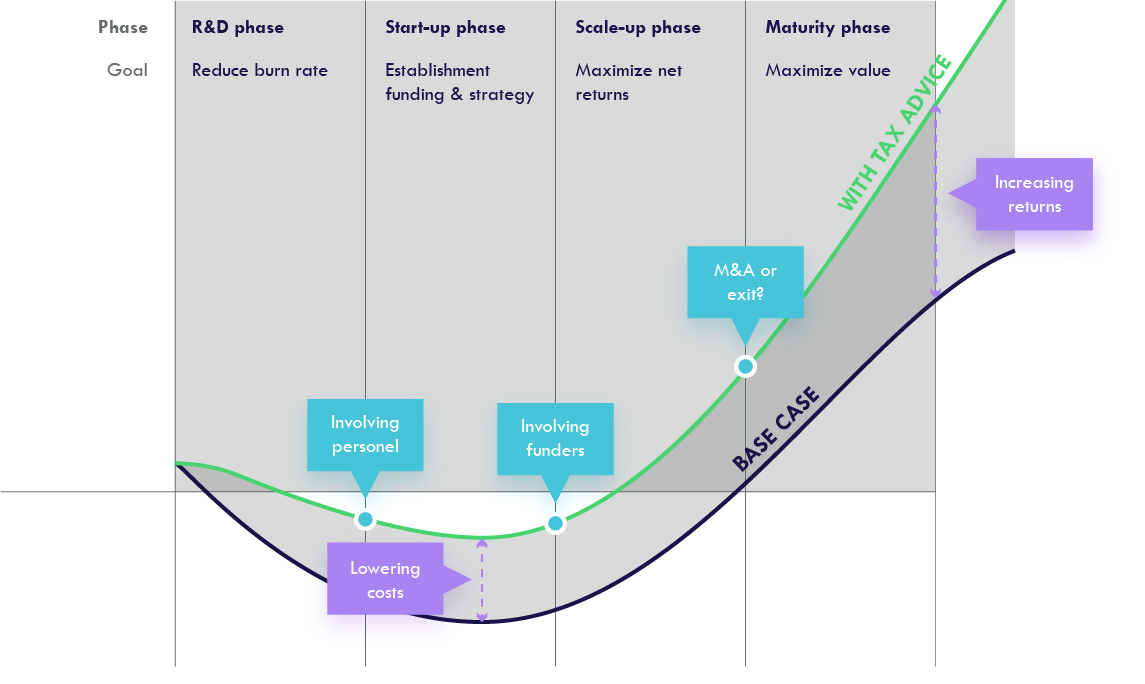

How can we contribute? By helping you identify your opportunities and prioritize what’s urgent. Supporting a growth firm requires proficiency in benefits and encouraging measures, and an opportunity-based approach to taxes. Why? Finding the right incentives can decrease your burn rate and lengthen your runway in the cost or R&D phase, then lower your effective tax rate in your profit phase. Thereby increasing your company’s return on investment and, with that, your company value. And that supports your fundability and allows your staff incentive plans to live up to their promise.

And sure, taxes are but a single line in your ledgers, but they are one that doesn’t necessarily mirror your bank account and can therefore seem like nothing but a burden. We are here to help turn that thinking around, and to make your tax functions work for you. Not through agressive tricks or eighties tax planning, but through finding the supporting regimes and a good balance between your taxes and your cashflow. We know where to find that, efficiently. Through academia or personal experience: we are a tax scaleup ourselves after all.

Put briefly on a larger scale: everyone benefits from your solution being the commercial success that you see for it. So let us back you up by finding what supports that success in your tax functions. We’re ready to get to work!